Are you ready to grow your business?

YOU HAVE QUESTIONS, AND WE HAVE ANSWERS!

Tax, Accounting, and Payroll

A small business should choose Advantage Tax, Accounting, and Payroll because they provide a team of highly qualified Certified Public Accountants (CPAs) who bring expertise, experience, and personalized service. The CPAs are well-versed in the latest tax laws, accounting standards, and payroll regulations, ensuring compliance and maximizing financial efficiency. They offer tailored services to meet the unique needs of each business, providing customized solutions that help achieve financial goals and streamline operations.

Advantage Tax, Accounting, and Payroll can help a small business save money in several ways. Their CPAs are experts in identifying tax deductions, credits, and incentives that a business may be eligible for, reducing tax liability. By managing payroll efficiently, they prevent costly errors and penalties associated with payroll tax compliance. Additionally, their comprehensive accounting services provide accurate financial data, enabling better decision-making and cost management. They help optimize financial processes, leading to increased profitability and cash flow.

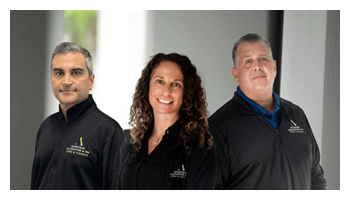

The Advantage Tax, Accounting, and Payroll team stands out due to their commitment to excellence, personalized service, and extensive expertise. They pride themselves on building long-term relationships with their clients, understanding their business inside and out. Their CPAs are not only knowledgeable but also approachable and dedicated to providing proactive advice. They stay ahead of industry trends and continuously update their skills to offer the most relevant and effective solutions. Their comprehensive service offerings, including tax planning, bookkeeping, payroll, and financial consulting, ensure that all financial needs are met under one roof.

More about advantage accounting team

The team at Advantage Tax, Accounting, and Payroll consists of 40 accountants and CPAs with exceptional qualifications. Many of our team members have pedigrees from prestigious institutions such as Harvard University, Florida State University, and Florida Atlantic University (FAU). Their advanced education and rigorous training ensure they are equipped with the latest knowledge and skills in accounting, tax, and financial management. This high level of expertise allows them to provide top-notch services and innovative solutions to meet the needs of small businesses.

Advantage Tax, Accounting, and Payroll ensures personalized service by assigning each client a dedicated accountant. This approach allows the assigned accountant to become deeply familiar with the client's business, financial situation, and specific needs. Clients benefit from consistent communication and a reliable point of contact who understands their unique circumstances. The dedicated accountant works closely with the client, providing tailored advice and solutions, and ensuring that any questions or concerns are promptly addressed.

The Advantage Tax, Accounting, and Payroll team is highly accessible for client support. Clients can easily reach their assigned accountant through various channels, including phone, email, and scheduled in-person or virtual meetings. The team's commitment to availability ensures that clients can get timely assistance whenever they need it. This level of accessibility fosters strong client relationships and provides peace of mind, knowing that expert help is always within reach.

Our Services

SERVICES

Accounting, Tax, and Payroll Solutions

Advantage Accounting & Tax is a leading nationwide firm specializing in Small Business Accounting, Tax, and Payroll Services. We cater specifically to businesses with 5-50 employees, offering comprehensive accounting solutions that enable business owners to focus on their core operations. Based in Palm Beach County, Florida, Advantage Accounting & Tax provides worry-free financial management for small businesses, making us the top choice among local CPA and Payroll firms.

Advantage Accounting & Tax offers comprehensive accounting and bookkeeping services tailored to meet the unique needs of small businesses. Our team of skilled CPAs ensures accurate financial record-keeping, timely financial reporting, and strategic financial planning. By managing your books, we help you maintain compliance, identify cost-saving opportunities, and improve your overall financial health. Contact us today to see how our expertise can streamline your accounting processes and free up your time to focus on growing your business.

Advantage Accounting & Tax provides robust support during IRS audits, offering expert guidance and representation to ensure a smooth audit process. Our experienced CPAs will help you gather the necessary documentation, respond to IRS inquiries, and address any issues that arise. We work diligently to minimize disruptions to your business and achieve the best possible outcome. Don't face an IRS audit alone—call Advantage today for professional support and peace of mind.

Choosing Advantage Accounting & Tax means partnering with a firm that understands the unique challenges of small businesses. Our team of CPAs offers personalized service, extensive expertise, and a commitment to your success. Whether you need help with accounting, bookkeeping, tax planning, or navigating an IRS audit, we provide solutions that save you time and money. Our comprehensive approach ensures your financial health is in good hands, allowing you to focus on what you do best. Call Advantage today to learn how we can support your business's financial needs.

Advantage Accounting & Tax offers expert tax preparation services to ensure your small business complies with all federal, state, and local tax regulations. Our team of CPAs meticulously prepares your tax returns, identifying all eligible deductions and credits to minimize your tax liability. With our thorough and accurate approach, you can avoid costly mistakes and penalties. Contact us today to streamline your tax preparation process and maximize your tax savings. Experience the peace of mind that comes with professional tax preparation.

Advantage Accounting & Tax provides strategic tax planning services designed to optimize your tax position throughout the year. Our CPAs analyze your financial situation and develop customized tax strategies to reduce your tax burden and enhance your financial performance. By proactively planning for tax obligations, we help you make informed business decisions and achieve long-term financial success. Call Advantage today to discover how our tax planning services can benefit your business.

Advantage Accounting & Tax ensures your business remains compliant with all state tax regulations, which can vary significantly from one state to another. Our knowledgeable CPAs stay current on state-specific tax laws and requirements, providing accurate and timely state tax filings. We help you navigate complex state tax issues, identify tax-saving opportunities, and avoid penalties for non-compliance. Reach out to Advantage today for expert assistance with your state tax obligations and keep your business on track.

Advantage Accounting, Tax & Payroll provides comprehensive payroll outsourcing services to streamline the payroll process for small business. Our team manages everything from payroll calculations and tax withholdings to direct deposits and payroll taxes. By entrusting us with your payroll needs, you can eliminate administrative burdens, reduce errors, and ensure timely and accurate payroll processing. Reach out to us to simplify your payroll management and concentrate on expanding your business. Enjoy the peace of mind that comes with professional payroll services.

Outsourcing payroll to Advantage Accounting & Tax provides numerous benefits, including increased accuracy, compliance, and efficiency. Our experienced CPAs stay up-to-date with the latest payroll regulations and tax laws, ensuring your business remains compliant and avoids costly penalties. Additionally, our payroll services save you time and reduce the risk of errors, allowing you to focus on core business activities. Call Advantage today to learn more about how our payroll outsourcing services can benefit your small business.

Advantage Accounting & Tax prioritizes the security and confidentiality of your payroll information. We implement robust security measures, including data encryption, secure access controls, and regular audits, to protect sensitive payroll data. Our team follows strict confidentiality protocols and adheres to industry best practices to safeguard your information. Trust us to handle your payroll with the highest level of security and professionalism. Reach out to Advantage today for secure and reliable payroll outsourcing services.